|

Buying a property with no deposit - REALLY?

At Your Advisor Group, we understand that saving for a home deposit can be challenging and you are tired of watching your money go into your landlord’s pocket. As the experts in delivering unique finance products, we love helping our clients find solutions. So why rent … when you can be in your own home with one of our specialist Home Starter Packages!

Can I buy a home without a current deposit? Yes! A “no” or low deposit home loan strategy is a unique and exclusive strategy that allows you to purchase a property (with little to no existing deposit). Your Advisor Group has access to a unique set of home loan lenders offering loans with a low deposit (as low as 5 to 10 percent); allowing you to borrow up to 100 percent of the purchase price and associated costs of buying a home. YOU MAY BE READY TO BUY TODAY!

How do I get a low deposit home loan?

We achieve this for you by combining:

Would a low deposit home loan be suitable for me?

This strategy is best suited to applicants who:

This strategy will NOT work for you if you:

This strategy is NOT LIMITED to first home buyers or owner-occupied purchasers. |

EXAMPLE: HERE IS AN EXAMPLE OF OUR CUSTOMERS, JOSH AND AMY, FROM QUEENSLAND

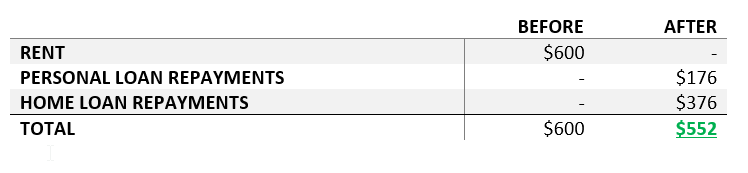

BEFORE, JOSH AND AMY WERE PAYING $600/WEEK IN RENT (DEAD MONEY TO A LANDLORD).

|

SOME GOOD TIPS TO CONSIDER

check out this explainer video

Are there any additional considerations I need to know about?

There are a few additional considerations to be aware of when considering this strategy:

|

Disclaimer: The information contained on this page has been provided as general advice only. The contents have been prepared without taking account of your personal objectives, financial situation or needs. All loan strategies are subject to ours or our suppliers and lender's terms and conditions and approval criteria. Always seek independent financial and/or legal advice. This strategy is subject to ours or our suppliers and lender's terms and conditions and approval criteria. Not everyone is suited to this strategy or the loan products offered and you should always consider your own circumstances before entering in to transactions. You should always seek independant financial and/or legal advice. This examples given are based on a hypothetical scenario using interest rates and repayments current at the time of publishing. This is only a guide and should not be used to influence or encourage any decisions regarding your own finances or financial benefits from using our services.