|

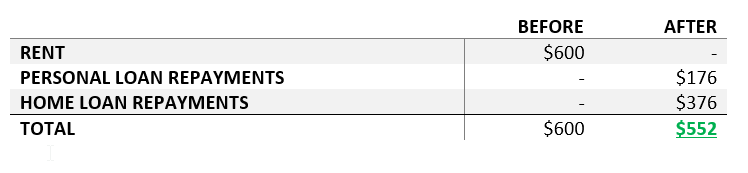

The answer is YES! A “no” or low deposit home loan strategy is a unique and exclusive strategy that allows you to purchase a property (with little to no existing deposit). Alpha Lend has access to a unique set of home loan lenders offering loans with a low deposit (as low as 5 to 10 percent); allowing you to borrow up to 100 percent of the purchase price and associated costs of buying a home. At Alpha Lend, we understand that saving for a home deposit can be challenging and you are tired of watching your money go into your landlord’s pocket. As the experts in delivering unique finance products, we love helping our clients find solutions. So why rent … when you can be in your own home with one of our specialist Home Starter Packages! How do I get a low deposit home loan? We achieve this for you by combining: 1. An unsecured personal loan (also known as GAP Finance) to cover any shortfalls in your deposit and additional costs (such as stamp duties, conveyancing, government fees). 2. A standard secured home loan. Can you give me an example? Here is an example of our customers ‘Josh and Amy’ in Queensland. BEFORE, JOSH AND AMY WERE PAYING $600/WEEK IN RENT (DEAD MONEY TO A LANDLORD). NOW THEY ARE PAYING $552/WEEK PLUS THEY OWN THEIR OWN HOME. ‘Josh and Amy’ are both working full-time, have strong incomes and clear credit histories. They currently pay $2,600 per month in rent! They have come to us wanting to buy a unit for around $400,000, but have NO Deposit! Step 1) Identify how much you will require to purchase your desired property. In this case we have identified the following amount of funds required for Josh and Amy to complete their purchase: · Deposit: $40,000 · Conveyancing/searches: $1500 · Miscellaneous (Government fees/valuation fees): $3250 · Stamp duty: $5,250.00 (or $0.00 with first home buyer concession) · Total: $50,000 Step 2) We arrange a 'Deposit loan/GAP Finance' Approval for $50,000 with our specialised Unsecured Personal Loan provider/s to cover any shortfall in the deposit and any purchase costs. This is usually over a 7-year period with an emphasis on paying this off as quick as possible via extra repayments or when the property has increased in value. Step 3) We arrange a Home Loan to borrow $360,000 + Lenders Mortgage Insurance with the bank (90% of the property value). This loan can have all the regular features and is usually priced in line with competitors. Step 4) Josh and Amy can go house hunting. With their approval they have the confidence to know exactly how much they can purchase for when looking at available properties. Would a low deposit home loan be suitable for me?

This strategy is best suited to applicants who: · Have strong, consistent incomes · Have clear credit histories · Show good management of banking, bills and finances (Note: Remember that your bank statements are scrutinised so consider how you spend your money). This strategy will NOT work for you if you: · Have unclear credit history or a low score · Are struggling with any of your current financial commitments, unable to pay bills on time or demonstrate any signs of financial hardship · Have uncertain employment · Have excessive debt* · Foresee any major changes in your circumstances This strategy is NOT LIMITED to first home buyers or owner-occupied purchasers. Are there any additional considerations I need to know about? There are a few additional considerations to be aware of when considering this strategy: 1. Interest rates could be, but are not always, marginally higher when borrowing above 90% of the property value. 2. Only certain lenders will accept a non-genuine savings deposit (GAP Finance personal loan). This may limit the lenders who we can consider when applying for your home loan. 3. Your loan will be subject to Lender’s Mortgage Insurance (‘LMI’). LMI is a premium added to your home loan that protects the lender. This is a one-time payment and varies depending on the home value, size of the loan and deposit. Usually this would be added to your home loan (also known as ‘capitalising,’ but in some cases this is not an option and may need to be included in your GAP Finance loan). OTHER TIPS TO CONSIDER 1. Money Talks: Although not mandatory, any funds you can contribute are a HUGE bonus. Savings, gifts, sale of unwanted assets, any amount will help reduce your shortfall and increase your chance of approval. 2. *Say Goodbye (to bad debt): After reviewing your finances, we may recommend that you say goodbye to some existing debt. Any high-interest loans or other borrowings holding back your cash flow and borrowing capacity. This could include a debt consolidation, lowered credit card limits or a refinance. We are experts in debt consolidation and can provide this service to your throughout your application. 3. Be realistic about your expectations of what you want to buy and how much you need to spend. This strategy is not for a beachside mansion. Disclaimer: The information contained in this document has been provided as general advice only. The contents have been prepared without taking account of your personal objectives, financial situation or needs. All loan strategies are subject to ours or our suppliers and lender's terms and conditions and approval criteria. Always seek independent financial and/or legal advice. This strategy is subject to ours or our suppliers and lender's terms and conditions and approval criteria. Not everyone is suited to this strategy or the loan products offered and you should always consider your own circumstances before entering in to transactions. You should always seek independant financial and/or legal advice. This examples given are based on a hypothetical scenario using interest rates and repayments current at the time of publishing. This is only a guide and should not be used to influence or encourage any decisions regarding your own finances or financial benefits from using our services. |

AuthorNick Cappelleri Archives

April 2021

Categories |

RSS Feed

RSS Feed