|

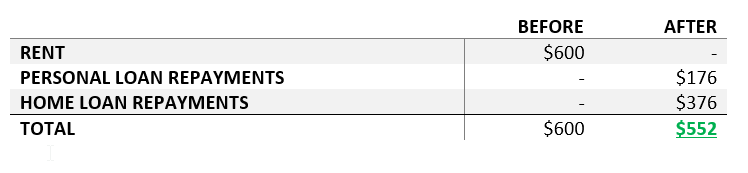

The answer is YES! A “no” or low deposit home loan strategy is a unique and exclusive strategy that allows you to purchase a property (with little to no existing deposit). Alpha Lend has access to a unique set of home loan lenders offering loans with a low deposit (as low as 5 to 10 percent); allowing you to borrow up to 100 percent of the purchase price and associated costs of buying a home. At Alpha Lend, we understand that saving for a home deposit can be challenging and you are tired of watching your money go into your landlord’s pocket. As the experts in delivering unique finance products, we love helping our clients find solutions. So why rent … when you can be in your own home with one of our specialist Home Starter Packages! How do I get a low deposit home loan? We achieve this for you by combining: 1. An unsecured personal loan (also known as GAP Finance) to cover any shortfalls in your deposit and additional costs (such as stamp duties, conveyancing, government fees). 2. A standard secured home loan. Can you give me an example? Here is an example of our customers ‘Josh and Amy’ in Queensland. BEFORE, JOSH AND AMY WERE PAYING $600/WEEK IN RENT (DEAD MONEY TO A LANDLORD). NOW THEY ARE PAYING $552/WEEK PLUS THEY OWN THEIR OWN HOME. ‘Josh and Amy’ are both working full-time, have strong incomes and clear credit histories. They currently pay $2,600 per month in rent! They have come to us wanting to buy a unit for around $400,000, but have NO Deposit! Step 1) Identify how much you will require to purchase your desired property. In this case we have identified the following amount of funds required for Josh and Amy to complete their purchase: · Deposit: $40,000 · Conveyancing/searches: $1500 · Miscellaneous (Government fees/valuation fees): $3250 · Stamp duty: $5,250.00 (or $0.00 with first home buyer concession) · Total: $50,000 Step 2) We arrange a 'Deposit loan/GAP Finance' Approval for $50,000 with our specialised Unsecured Personal Loan provider/s to cover any shortfall in the deposit and any purchase costs. This is usually over a 7-year period with an emphasis on paying this off as quick as possible via extra repayments or when the property has increased in value. Step 3) We arrange a Home Loan to borrow $360,000 + Lenders Mortgage Insurance with the bank (90% of the property value). This loan can have all the regular features and is usually priced in line with competitors. Step 4) Josh and Amy can go house hunting. With their approval they have the confidence to know exactly how much they can purchase for when looking at available properties. Would a low deposit home loan be suitable for me?

This strategy is best suited to applicants who: · Have strong, consistent incomes · Have clear credit histories · Show good management of banking, bills and finances (Note: Remember that your bank statements are scrutinised so consider how you spend your money). This strategy will NOT work for you if you: · Have unclear credit history or a low score · Are struggling with any of your current financial commitments, unable to pay bills on time or demonstrate any signs of financial hardship · Have uncertain employment · Have excessive debt* · Foresee any major changes in your circumstances This strategy is NOT LIMITED to first home buyers or owner-occupied purchasers. Are there any additional considerations I need to know about? There are a few additional considerations to be aware of when considering this strategy: 1. Interest rates could be, but are not always, marginally higher when borrowing above 90% of the property value. 2. Only certain lenders will accept a non-genuine savings deposit (GAP Finance personal loan). This may limit the lenders who we can consider when applying for your home loan. 3. Your loan will be subject to Lender’s Mortgage Insurance (‘LMI’). LMI is a premium added to your home loan that protects the lender. This is a one-time payment and varies depending on the home value, size of the loan and deposit. Usually this would be added to your home loan (also known as ‘capitalising,’ but in some cases this is not an option and may need to be included in your GAP Finance loan). OTHER TIPS TO CONSIDER 1. Money Talks: Although not mandatory, any funds you can contribute are a HUGE bonus. Savings, gifts, sale of unwanted assets, any amount will help reduce your shortfall and increase your chance of approval. 2. *Say Goodbye (to bad debt): After reviewing your finances, we may recommend that you say goodbye to some existing debt. Any high-interest loans or other borrowings holding back your cash flow and borrowing capacity. This could include a debt consolidation, lowered credit card limits or a refinance. We are experts in debt consolidation and can provide this service to your throughout your application. 3. Be realistic about your expectations of what you want to buy and how much you need to spend. This strategy is not for a beachside mansion. Disclaimer: The information contained in this document has been provided as general advice only. The contents have been prepared without taking account of your personal objectives, financial situation or needs. All loan strategies are subject to ours or our suppliers and lender's terms and conditions and approval criteria. Always seek independent financial and/or legal advice. This strategy is subject to ours or our suppliers and lender's terms and conditions and approval criteria. Not everyone is suited to this strategy or the loan products offered and you should always consider your own circumstances before entering in to transactions. You should always seek independant financial and/or legal advice. This examples given are based on a hypothetical scenario using interest rates and repayments current at the time of publishing. This is only a guide and should not be used to influence or encourage any decisions regarding your own finances or financial benefits from using our services. It's better with a broker ... why you should use a broker for your next finance application17/12/2020 There are unlimited options when it comes to seeking home and personal finance. In addition to being able to go directly to a bank to seek finance, you can also use a specialist broker who is trained to ensure that you are fully aware of the type of loans best suited to your needs and will also help present your application in the best way possible to the lender to get APPROVED.

Why use a broker? 1. We work for you (not the bank!) Determining your needs and borrowing capacity As brokers, we work on your behalf and in your interest to determine what you can afford to borrow, understand every aspect of your financial commitments and goals and use our expert product and market knowledge to negotiate with lenders and get you the best loan arrangement and products. We aren't tied to any particular lenders or products. We provide you with a variety of choices and work with multiple lenders to ensure that your loan is competitive and meets your long term goals. We not only analyse the best interest rates, but also make sure that your loan features work for you. For example, flexibility with repayments, loan terms, re-draw facilities and access to equity. Presenting your application It is important to understand that when securing finance you only need to submit the necessary information to satisfy lending criteria. Presenting your application in the right way is a vital element to obtaining approval. Our qualified brokers are trained to present your loan in the strongest way possible and may help negotiate a better outcome. 2. We simplify the application process We also save you time by making the banks' tedious application processes convenient and streamline with our innovative electronic paperwork collection, handling liaison with the lenders and supporting you right through to settlement. We can use our relationships with lenders to secure finance for you as quickly as possible. 3. The Alpha Lend difference At Alpha Lend, our qualified brokers have intimate knowledge of property and asset purchase processes. Benefit from our combined years of experience and expert knowledge. We will guide you through each stage of purchase, empowering you to make educated decisions for your finances. It is that special time of year again. A time for cheer (lavish food, travel, gifts – among our favourites) and sometimes, a time of financial pressure or change. Why not make it extra memorable by spending this Christmas stress-free?

Whether you:

Alpha Lend has the knowledge, experience, and relationships with Australia’s top lenders and smaller players to get you the finance you need by Christmas or the New Year. Personal loan v credit card? Spreading the cost of Christmas is an easy way to relieve some of the financial pressure surrounding this season. Loading a credit card up at Christmas time can be an easy way to overspend (with only your credit-limit to set the ceiling of your purchases, and minimum monthly repayments that can mean your debt is ongoing for long periods). Instead, by getting a personal loan you can be sure that you are committing to an amount and period of instalments that you can comfortably afford and pay off in a timely manner. Whether your personal loan is to cover more minor costs like the Christmas period gifts and expenses or for something more major like relocation or renovations, we have a personal loan to suit you. Lightning-fast Application Process Applying for a personal loan this Christmas is fast and convenient. With our online-based application process. To make turnaround times extra fast, be prepared with the following things for your broker to submit your application:

As brokers, we work on your behalf and in your interest to determine what you can afford to borrow, understand every aspect of your financial commitments and goals and use our expert product and market knowledge to negotiate with lenders and get you the best personal loan arrangement and products. To start your personal loan application today, contact us here. Fantastic news for all current and future owner-occupiers … on the 29 November 2020, the Australian Government announced an extension to the Home Builder program until 31 March 2021.

What is the Home Builder Grant? The Home Builder Grant is a program introduced by the Australian government to assist in the support of the residential construction and employment sector. According to the Australian Treasury: “HomeBuilder provides eligible owner-occupiers (including first home buyers) with a grant to build a new home or substantially renovate an existing home.” Who is eligible for the Home Builder Grant? There is a common misconception that the Home Builder Grant is only eligible to first home buyers. Whilst there are several grants available for applicants purchasing their first property, the Home Builder Grant is available to all eligible persons who:

There are also certain requirements in regard to the property, for example:

What if I live in NSW or Victoria? Property can be more expensive here. The Australian government have acknowledged that the $750,000 property price cap for building in some states is unrealistic. Therefore, for new building contracts signed between 1 January 2021 and 31 March 2021, property price caps are also being increased to account for the difference in State markets. For example, in New South Wales the cost of the land and build after completion will be increased to $950,000 and in Victoria to $850,000. How can the grant help me secure a home loan? Can I use it to assist with my deposit? Many prospective home buyers and builders have been left confused by how the Home Builder Grant can assist them in securing the finance needed to get into their own home because the grant is paid directly into your nominated bank account, only when there is evidence that the building foundations have been laid and first progress payment has been made. This has meant that many lenders have remained reluctant to consider the impending payment of the grant as part of borrower’s proof of funds to complete the sale. What about those who need the grant to secure finance? Luckily, Alpha Lend has exclusive access to lenders who are willing to recognise the grant as part of your deposit. This does not change how the grant is paid, only how the lender assesses the application for finance. To find out more about the key eligibility criteria, requirements to use the grant as part of your deposit or to discuss applying for a home loan today, contact your specialist brokers at Alpha Lend. For more information: Keep reading at the Australian Treasury website here. Borrower Update: The Keys to Ensuring Your Finance Application Success

As the economic effects of Covid-19 continue to evolve rapidly, it is critical for borrowers to remain well-guided when applying for finance. Covid-19 and Finance Approvals It’s no surprise that financial institutions have tightened their credit assessment and toughened their credit criteria. Sure, the government has relaxed regulations, making it easier for lenders to approve loans, but in reality lenders remain obligated to ensure a borrower can repay a proposed loan and do so without hardship. The Federal Government, State Government and even Credit Providers themselves have provided some excellent relief strategies to help struggling Australians through these times, particularly early on. As good as these relief options are/were, utilising these options also indicates that you have recently, or currently are, experiencing financial hardship of some sort…. not what a lender wants to see in a potential borrower! Some tell-tail signs that a borrower is experiencing Covid-19 Hardship. Superannuation Withdrawal The Australia government announced that eligible Australians may be able to access up to $20,000 of their super early IF experiencing severe financial hardship. Whilst this sounded tempting, withdrawing your super (aside from costing you double when it comes time to retire) is a major red flag for lenders when assessing finance applications. If someone has applied for a superannuation withdrawal, they are technically and legally declaring that they are in financial hardship. When a lender sees this withdrawal, they can only assume your declaration was truthful and therefore you are in hardship. Job-Keeper Payments Job-Keeper has been a fantastic initiative to keep businesses running and people employed. From a lending perspective, however, it demonstrates potential instability in the applicant’s employment continuity. In other words, although you are gainfully employed (and your employer’s financial position is not in your control), you could be rejected based on “job-keeper” appearing on your payslip which, to a lender, reveals your that your employer has experienced a substantial downturn in their business, in turn suggesting your job may not be safe! The outlook on this has eased somewhat now, with round one of Job-Keeper finished and a new round commenced, we suspect that lenders will likely frown upon applicants still receiving Job-Keeper. Mortgage or Loan Payment Holidays It is not surprising that there has been a related increase in stress regarding the payment of mortgages and loans whilst people navigate through the Covid-19 crisis. Lenders have acted accordingly giving borrowers a chance to pause or ‘defer’ their mortgage and loan repayments. If have already or you are considering a mortgage or loan repayment pause, remember the implication this will have on a future loan application. Similar to Super withdrawals, by freezing your repayments on existing credit facilities, you have demonstrated current or recent financial hardship to a potential lender. Managing your living expenses One measure financial regulators have also put in place to ensure financial institutions are lending responsibly during this time is more detailed assessments to demonstrate that you can meet proposed loan repayments. As your finance brokers, we also have a legal duty to ensure that the loan we find for you is in your best interests. Previously, your day-to-day expenditure was assessed with a Household Expenditure Measure or ‘HEM’ which averaged living expense figures to estimate living costs. Whilst this still offers an indication to lenders of what you can afford to repay, they now seek a more detailed analysis of what and how much you are spending. Most lenders require a detailed break down of living expenses and usually need to look at your last three months (or more) of bank account and credit card transactions. If Covid-19 has forced you to regularly overdraw your accounts, cover living costs through credit cards or required you to regularly cash advance, you may be at risk of being declined on a loan application. Now is a great time to review your discretionary (non-essential) spending and improve your credit assessment profile. Do you really need that new suit or dress when you are working from home? Don’t Worry… We Have Solutions We understand that for many, these are uncertain times as the situation surrounding the pandemic continues to unfold in Australia and globally. Luckily, Alpha Lend are here to support you in exploring the solutions that may be available to you. If any of the above matters concern you or you simply want a better understanding of the current financial climate and what you can borrow or do to improve your borrowing power, now is the time to reach out. Our qualified brokers are here to answer your questions and look at your circumstances to make sure you’re prepared for any potential changes to your financial needs.

Get in touch today via the link here or call (07) 5534 8000 to discuss in person today. You can also stay up to date with the latest news and promotions from Alpha Lend by following us on Instagram and Facebook. |

AuthorNick Cappelleri Archives

April 2021

Categories |

RSS Feed

RSS Feed